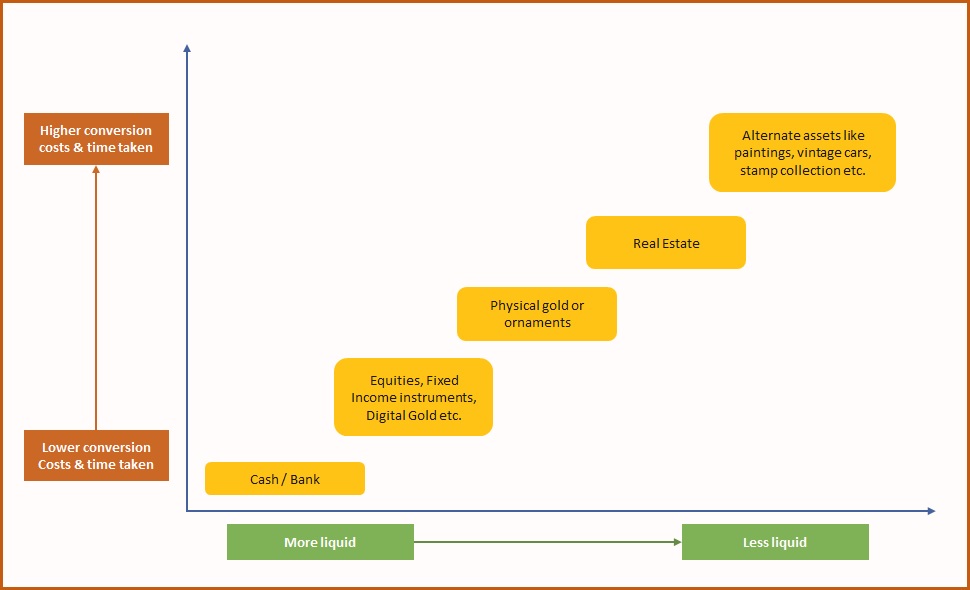

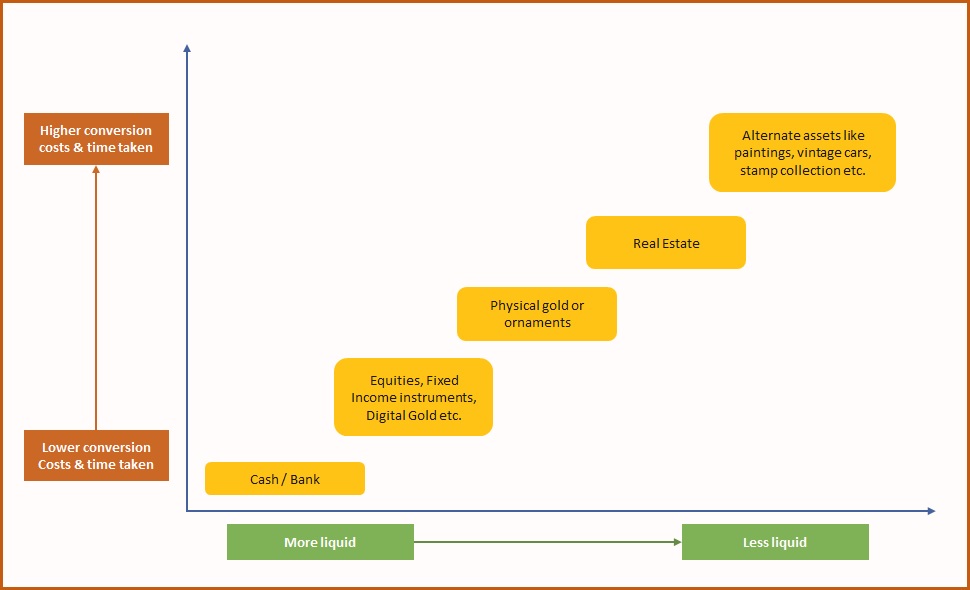

Maintaining financial liquidity essentially means the ease with which you can convert investments into ‘cash or bank’. The faster the conversion and lower the effort, the more liquid an asset is. For example, cash or free balance in your bank account is considered the most liquid form of money.

“Live as if you were to die tomorrow, learn as if you were to live forever.”

– By Mahatma Gandhi

I cannot think of any better quote, to sum up, the year 2020. The pandemic taught us the importance of maintaining financial liquidity and contingency reserves to deal with unsolicited situations and financial stress. Maintaining an ‘emergency surplus’ which is suggested to be approximately 12-18 months of expenses is essentially the first step in your financial planning journey.

Read more on the subject of investment plan in my article “Thumb rules of making an investment plan“.

Cost to convert to cash

The cost to convert an investment into cash is one important aspect. In general, all the assets are convertible into cash but the cost to convert vary. For some assets, the conversion cost could be marginal while for others, the cost may be very high. E.g. a mutual fund may apply an exit load when liquidated but that could be a small percentage of asset value. On the other hand, to liquidate a real estate investment, you may end up paying brokerage to the tune of 1 to 2% of the value of the property.

Time to convert to cash

Time to convert to cash could be another critical constraint. In continuation of the example above, while both mutual funds and real estate can be converted into cash, the difference lies in the time (and effort) it would take to do so. Needless to mention, to convert less liquid or illiquid assets like real estate, paintings, etc. into cash needs more time.

The below chart summarizes the asset and its correlation with its liquidity and time/costs you can expect to incur to convert them to cash. Although cash/bank is also included in the chart, there is no time required to convert but there could be some holding costs, even though marginal.

The above list is only illustrative and does not cover all the possible assets, such as:

1. Real estate investment trusts (REITs)

2. Restricted shares, bonds (or any such investment with covenants)

3. A hedge fund or private equity

4. Equity crowdfunding

5. Futures and options

6. Foreign currencies

7. Commodities, etc.

Read more about equity crowdfunding in my article – “Alternative investment options for modern day investors”

Price fluctuation

Price fluctuation is an important factor for assets that witness frequent movement in their values. Based on the type of asset and your eagerness to sell, price realization may significantly vary. Distress sale of any asset can significantly jeopardize the realized value.

Liquidity

Liquidity in the market refers to the ability of the seller to liquidate the assets. Generally, we assume that an efficient and fair marketplace exists which allows assets to be bought and sold easily and quickly. The more well organized a market is, the more liquid assets are. One good example is our efficient financial markets where shares/securities can be easily bought/sold at prevailing rates, thereby making equities a highly liquid asset class. However, all the assets may not have a similarly efficient marketplace, which may lead to long lag times and higher costs to convert.

Emergency fund as the start point

To start with, you must maintain sufficient emergency cash to be able to meet your living expenses for 12-18 months. Secondly, you must keep a reasonable understanding of the liquidity status of assets in your portfolio. And to sum up, if all goes well you serve your investments through investing regularly and proper management, but in case of any unwanted circumstance, investments must be able to serve you.

—————————————————————–

The author is a senior finance professional with over fifteen years of work experience in corporate finance and has an affinity for personal finance and investment management. Please leave your comment or share thoughts on this article via email at decodefinance.in@gmail.com. For more articles, please visit the website www.decodefinance.in.

Disclaimer:

The author has used his knowledge, experience, and understanding of the subject to write this article. Any views, opinions, and thoughts mentioned in the article belong solely to the author and not necessarily to the author’s employer (past or current), organization, committee, or other group or individual.

Under any circumstances, the author shall not be liable for any views or analysis expressed in this note. Further, the opinions expressed are not binding on any authority or Court. We advise readers to consult their financial advisor for assistance in their specific case.

Helpful Article !

Very well articulated content with a good overview coupled with macro insights.

Good one dear