The Government of India, vide its notification dated May 12, 2021, announced the Sovereign Gold Bond Scheme 2021-22, Series I-VI. The first gold bond scheme was launched in November 2015, and there have been several series since then. The last one was 2020-21 series, twelfth tranche of which closed in March 2021. Here are the key features and advantages of sovereign gold bond scheme and details regarding how do you invest.

Tranches and subscription dates under the 2021-22 series

The subscription and date of issuances shall be as per the table below:

For historical price information for past gold bond series, visit the National Stock Exchange website. Here is the link for quick reference – https://www.nseindia.com/market-data/sovereign-gold-bond.

Salient features of the Sovereign Gold Bond Scheme

- The Reserve Bank of India issues the gold bonds on behalf of the Govt. of India

- Resident individuals, HUFs, Trusts, Universities and Charitable institutions are eligible to purchase

- Bond tenor is 8years, with an exit option available after 5years

- Bonds are tradable on stock exchanges

- Nomination and cancellation is possible under the scheme

- A Non-resident Indian (NRI) may get security transferred in his/her name as a nominee on the death of the investor

- The NRI must hold the security until maturity or early redemption

- Interest and maturity proceeds of the investment are not repatriable

- The gold bonds issued in the form of Stock Certificate are transferable

Denomination and subscription limits

Issuance of bonds will occur in the denomination of one gram of gold and multiples thereof. The minimum limit of subscription is 1 gram of gold, and the maximum investment limits are as per below:

| Investor type | Maximum limit |

| Individual | 4kg |

| Hindu Undivided Family (HUF) | 4kg |

| Trusts and similar entities | 20kg |

Definitions:

- ‘Person’ and ‘Resident of India’ is as defined in the Foreign Exchange Management Act, 1999

- ‘Trusts’ are meant to describe a trust constituted/formed as per the Indian Trusts Act, 1882, or public or private trust included or recognized under the provisions of any Central or State Law

- ‘Charitable institution’ to mean a company registered under section 25 of the Indian Companies Act, 1956 or section 8 of The Companies Act, 2003 or as defined in the notification

- ‘University’ means a university established or incorporated by the Central, State or Provincial Act and includes an institution declared under section 3 of the University Grants Commission Act, 1956

The ceiling prescribed above applies to the total bonds purchased under different tranches and those purchased from the secondary market. However, the limit will not include the holding as collateral by banks and other financial institutions.

In the case of a joint holding, the limits will be applicable only for the first holder.

Pricing of the issue

The nominal value of the gold bond will be the simple average of the last three days closing price of gold of 999 purity. The closing price is as published by the Indian Bullion and Jewellers Association Limited.

The nominal price will be lesser by Rs 50 per gram for the investors applying online and paying through digital mode.

Interest payable on the nominal investment value

Investors will earn an interest at the rate of 2.5% per annum on the nominal value, payable half-yearly. The last interest shall be payable upon maturity along with the principal amount.

Tax treatment

Interest income on gold bonds is taxable under the provisions of the Income Tax Act, 1961. Further, the act exempts any capital gains arising to an individual upon redemption. In the case of a transfer, indexation benefits are available to calculate long-term capital gains.

How do you invest in sovereign gold bonds

You can apply for the bonds using Form A. The form clarifies grams (in units) of gold, the applicant’s full name and address. Know Your Customer (KYC) norms as applicable to the physical purchase of gold would apply here. A voter id, Aadhar card, or TAN/Passport will be required. You must furnish a PAN card copy with the application.

Who are authorized to receive the application for bonds:

- Scheduled commercial banks – here is the List

- Designated post offices

- Stock Holding Corporation of India Ltd (SHCIL)

- National Stock Exchange of India Ltd, and,

- Bombay Stock Exchange Ltd

The receiving office shall provide an acknowledgement receipt as per Form B upon receiving the application.

You can purchase the gold bonds by making payment in Indian rupees. A cash payment is possible up to a maximum of Rs20,000/-. All the other payment modes like a demand draft, a cheque, or electronic banking are available.

Please remember that any incomplete application is liable to be rejected. Therefore, a careful evaluation of all the details is mandatory.

Form of issue of gold bonds

The issuance of gold bonds will happen as per the specified format, like a stock certificate. Further, the gold bonds are eligible to be converted to Demat form.

Why should you invest in gold bonds?

For the investors who would like to invest in gold, the scheme offers a few compelling advantages. A few are listed below:

- Unlike the traditional form of gold, no physical storage required

- Digital gold, hence it is safe and secure

- Guaranteed returns of 2.5% per annum

- Redemption exempted from the long-term capital gains tax

- Flexibility to redeem the bonds after completion of 5years

- No GST on the sovereign gold bond purchase, unlike applicable on the purchase of gold in physical form

- Since this is a digital subscription to gold, there are no making charges

- Bonds are tradeable on stock exchanges; therefore, they are highly liquid

- It is possible to use Sovereign Gold Bonds as collateral security

Redemption happens at market value, based on the simple average of the closing price of gold of 999 of the previous three days as published by the India Bullion and Jewellers Association (IBJA).

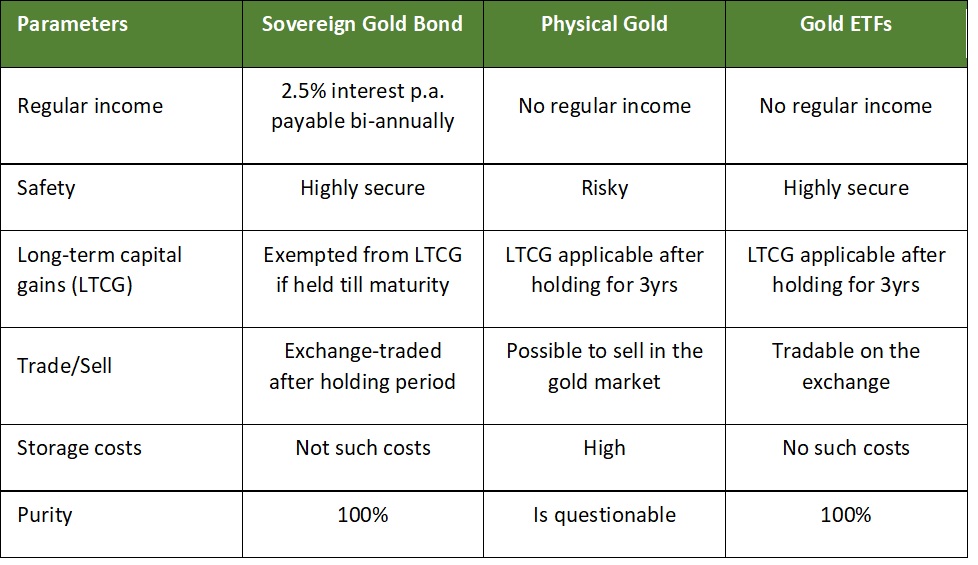

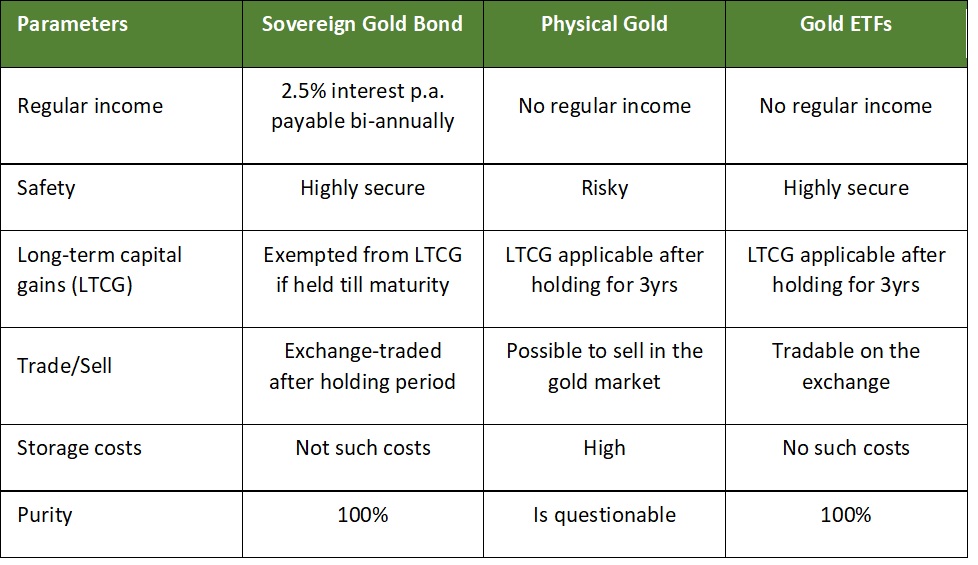

Comparison of different forms of owning gold

Here is a comparison of different forms of gold ownership:

The bottom line – is the sovereign gold bond a good investment?

Gold prices witnessed a fair bit of volatility recently. The prices may remain under the weather as the recent price trend is volatile. Given an uncertain global economic recovery pace, gold prices may continue to remain fragile. Therefore, in the medium term, returns from the gold bond may remain under pressure.

Long-term prospects of gold as an asset class remain intact. For investors looking at the mid-long term investment horizon, gold bonds are a good option.

Exemption of redemption from long-term capital gains tax for individuals for the bonds held until maturity is an added advantage.

Lastly, gold bonds are incredibly convenient vs the traditional form of buying physical gold. And, payment of interest provides a regular stream of income.

The objective of allocating investible surplus into different asset classes is to hedge risk through diversification and maximize returns.

Do read here to learn more about other asset classes here.

The author is a senior finance professional with over fifteen years of work experience in corporate finance and has an affinity for personal finance and investment management. Please leave your comment or share thoughts on this article via email at decodefinance.in@gmail.com. For more articles, please visit the website www.decodefinance.in.

Disclaimer:

The author has used his knowledge, experience, and understanding of the subject to write this article. Any views, opinions, and thoughts mentioned in the article belong solely to the author and not necessarily to the author’s employer (past or current), organization, committee, or other group or individual.

Under any circumstances, the author shall not be liable for any views or analysis expressed in this note. Further, the opinions expressed are not binding on any authority or Court. We advise readers to consult their financial advisor for assistance in their specific case.